How Decentralized Finance is Reshaping Money, Markets, and Opportunity

finTech, learn, MONEY

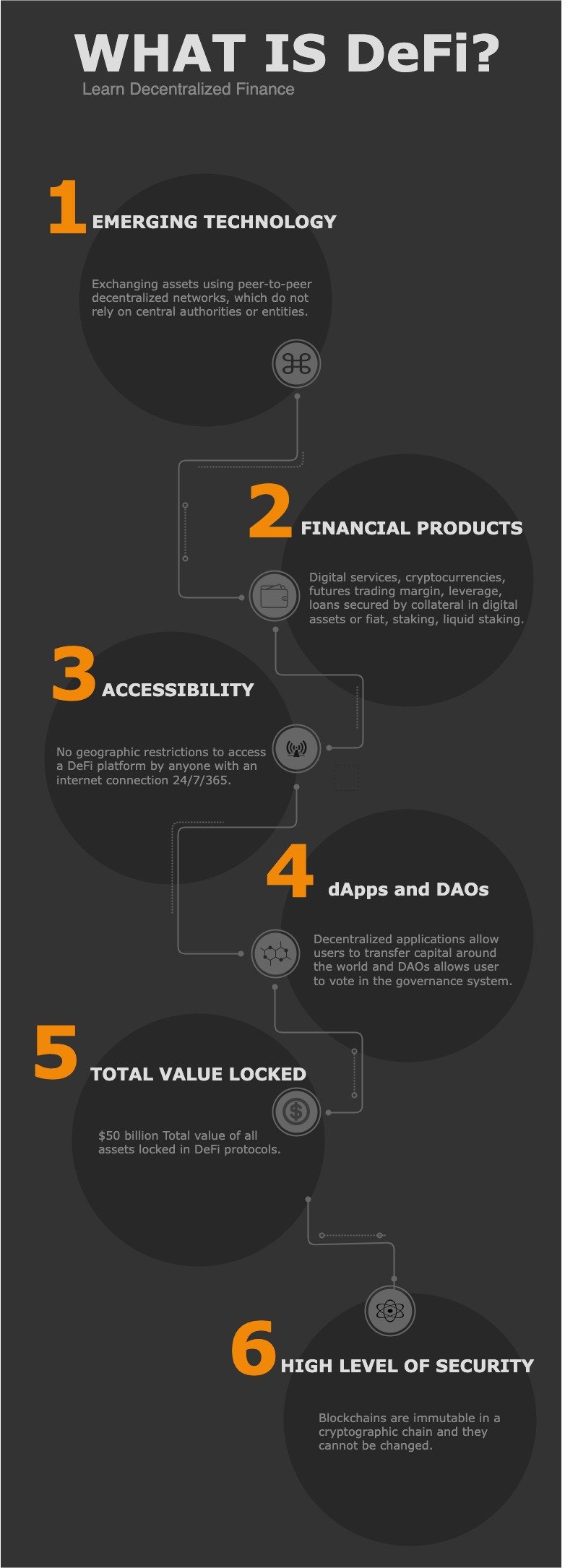

Decentralized Finance, or DeFi, is one of the most exciting developments in the world of finance today. But what exactly is DeFi, and why is it generating so much buzz in 2025?

In short, DeFi is transforming how we think about money. By leveraging blockchain technology, smart contracts, and digital currencies, DeFi platforms allow individuals to access financial services—like lending, trading, and even insurance—without relying on traditional banks or brokers. The beauty of DeFi lies in its openness, transparency, and ability to offer financial services to people who have been excluded from the traditional system.

What Is DeFi?

At its core, DeFi refers to a new ecosystem of financial services built on blockchain technology, which is inherently decentralized. Unlike traditional financial systems, which rely on intermediaries like banks, brokers, or insurance companies, DeFi platforms allow users to directly interact with financial products and services, often in a completely peer-to-peer environment.

What sets DeFi apart from traditional finance is the removal of the middleman. For example, instead of borrowing money from a bank, you can borrow it from a peer using a decentralized lending platform. Similarly, instead of using a centralized exchange to trade stocks, you can trade cryptocurrencies on decentralized exchanges (DEXs) without the need for a third-party institution to facilitate the transaction.

Key Components of DeFi: How Does It Work?

Blockchain & Smart Contracts: The backbone of DeFi is blockchain technology. The blockchain acts as a digital ledger that records every transaction in a transparent, secure, and immutable way. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They automatically enforce and execute the contract once the conditions are met—no intermediaries necessary.

Decentralized Applications (DApps): DApps are the user interfaces of DeFi platforms. These are applications built on blockchain networks (such as Ethereum) that allow users to interact with the underlying DeFi services like lending, borrowing, or trading.

Tokens and Cryptocurrencies: In DeFi, tokens play a crucial role. These could be digital currencies like Ether (ETH) or stablecoins like DAI, which are designed to maintain a stable value relative to a traditional asset like the US dollar. These tokens enable users to interact with the DeFi ecosystem—whether it’s lending tokens to earn interest or trading tokens on decentralized exchanges.

Top DeFi Use Cases in 2025

DeFi is not just a buzzword—it's a rapidly growing space offering real, tangible applications. Here are some of the most impactful use cases in 2025:

Lending and Borrowing:

DeFi platforms like Aave and Compound have revolutionized lending. Instead of borrowing from a bank, you can now borrow cryptocurrency or stablecoins directly from other users in a decentralized fashion. The process is transparent and doesn’t require approval from a central authority. Loans are often over-collateralized (meaning you need to put up more assets than you borrow) to ensure the system remains secure.Decentralized Exchanges (DEXs):

DEXs, like Uniswap and SushiSwap, allow users to trade cryptocurrencies without relying on a centralized exchange (such as Binance or Coinbase). This eliminates the need for a trusted intermediary. Transactions are facilitated directly between peers through an automated market maker (AMM) system, where liquidity is provided by users who earn fees for their participation.Stablecoins & Payments:

One of the significant benefits of DeFi is the use of stablecoins. These are digital currencies that are pegged to real-world assets (like the US dollar), providing a stable store of value. In DeFi, stablecoins like USDC and DAI are used for remittances, trading, and as collateral for loans. DeFi platforms are allowing people to transfer funds across borders quickly and at a fraction of the cost of traditional financial systems.Yield Farming & Staking:

Yield farming is a popular way for DeFi users to earn passive income. It involves providing liquidity to DeFi protocols (by lending your tokens or adding them to liquidity pools) and earning rewards in the form of interest or new tokens. This system is lucrative, but it can also be risky as the returns often depend on the volatility of the assets involved.Insurance:

Traditional insurance systems are slow, opaque, and often inaccessible to many people. DeFi insurance protocols like Nexus Mutual aim to disrupt this by using smart contracts to provide decentralized risk coverage. Users can insure themselves against specific risks (such as flight delays or cyberattacks) in a peer-to-peer manner, often at lower costs and with greater transparency.Asset Tokenization:

One of the most exciting developments in DeFi is asset tokenization. This refers to the ability to create digital tokens that represent ownership in real-world assets like real estate, fine art, or even commodities. This opens the door to fractional ownership, allowing anyone to invest in high-value assets that were previously out of reach.Gaming & NFTs:

Play-to-earn games, powered by DeFi protocols, are revolutionizing the gaming industry. Players can earn cryptocurrency by participating in the games, and NFTs (non-fungible tokens) allow for unique digital assets like in-game items or art to be bought, sold, and traded.

Emerging Trends Shaping DeFi in 2025

As the DeFi space matures, several emerging trends are set to shape its future:

Cross-Chain Interoperability: The ability for different blockchains to communicate with each other seamlessly is becoming a critical feature for DeFi platforms. This will enable users to move assets freely across various blockchain networks, providing greater liquidity and reducing the risk of platform lock-in.

Institutional Adoption: In 2025, we’re seeing greater involvement from traditional financial institutions. Banks, hedge funds, and large asset managers are slowly integrating DeFi solutions into their operations, recognizing the potential to tap into new markets and offer more competitive products.

AI & DeFi: Artificial intelligence is starting to play a role in automating portfolio management, analyzing risk, and optimizing DeFi protocols. AI could make decentralized finance more accessible and efficient, helping users navigate the complexities of DeFi platforms.

Risks and Challenges

While DeFi offers tremendous opportunities, it’s not without its risks:

Security: Smart contracts, although secure, can contain bugs or vulnerabilities that could be exploited by hackers. Major hacks and scams have already occurred in DeFi platforms, highlighting the need for better security and auditing.

Regulatory Uncertainty: DeFi operates in a legal gray area in many countries. Governments are still grappling with how to regulate decentralized financial systems, especially in terms of KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

User Complexity: The DeFi space can be intimidating for newcomers. Setting up wallets, managing gas fees, and navigating decentralized platforms can be a steep learning curve.

How to Get Started with DeFi

If you're ready to explore DeFi, here's how to get started:

Create a Wallet: The first step is to set up a crypto wallet. MetaMask and Trust Wallet are popular options for interacting with DeFi platforms.

Learn the Basics: Start by exploring platforms like Uniswap or Aave and familiarize yourself with how decentralized exchanges and lending protocols work.

Use DeFi Safely: Always make sure to research platforms thoroughly. Use hardware wallets for larger sums of money and avoid connecting your wallet to untrusted sites.

The Future of DeFi

In 2025, DeFi is more than just a trend—it’s becoming an integral part of the financial ecosystem. As the technology matures and regulatory frameworks take shape, DeFi will likely continue to grow, becoming more accessible and integrated with traditional finance.

Conclusion

DeFi represents a paradigm shift in how we think about money. By removing intermediaries, lowering costs, and making financial services more accessible, DeFi is democratizing finance. While challenges remain—especially around security and regulation—the potential of DeFi to create a more inclusive, transparent, and efficient financial system is undeniable.

Are you ready to explore the world of DeFi? Share your thoughts, experiences, or predictions for the future of decentralized finance in the comments below!

Join the conversation on Twitter or LinkedIn, following #DeFi2025, and let's grow together!

About the Author

Razvan Chiorean is the published author of compoundY and a cutting-edge researcher in quantum computing, AI-ML, and blockchain technology. Through his #AIResearch handle, Razvan continues to research, blog, and educate, bridging cultures and inspiring technological progress, while continually sharing his research and insights. ☆☆☆

Explore the Latest Posts

A Balanced Digital Life

Explore DeFi Inspired Art

Explore More

Archive

- June 2025

- May 2025

- April 2025

- January 2025

- December 2024

- October 2024

- September 2024

- August 2024

- July 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

AI Factories are redefining industry — where data becomes intelligence, and automation drives the Fourth Industrial Revolution.